How it works

The benefits of our Bridging Loan

3 months interest free

6 months of no repayments*^

6 or 12 month bridging loan period

Buy now, sell your old home later

Sell your current property at any time within the bridging period

Live in your old property until your new home settles

Need to know more? Here's the whole offer

Free guides & reports

Create a property report

Get a list of the similar property sales in the area.

Get a list of properties currently on the market, similar to the one you are looking at.

Get an estimation of the value of the property.

Your guide to Bridging Loans

Bridging loans lets you buy a new home now while you wait to sell your old one, later. When you sell your old property, the sale funds are used to pay down your Bridging Loan, after which the loan remaining will convert to a standard variable home loan. Read out guide for a more detailed explanation.

Frequently asked questions

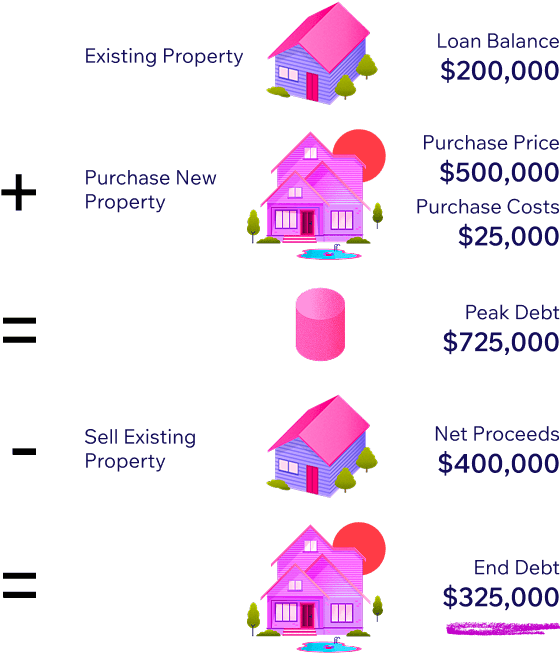

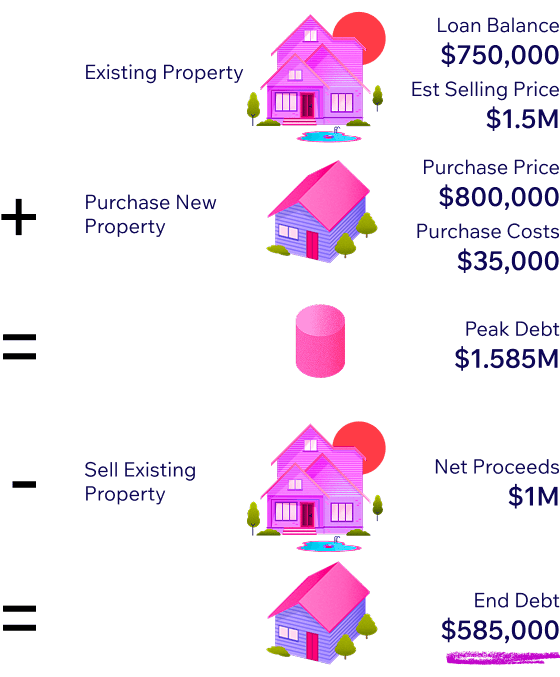

A Bridging Loan gives you the funds to buy a new home now while you work to sell your old one within a ‘bridging’ period of either 6 or 12 months, starting from when you settle your new property.

The loan on your current home is refinanced and bundled with the loan amount of your new home to make the Bridging Loan. The bridging period of the loan exists until you sell your old home, at which point the sale funds are applied to reduce your loan, which then converts to a standard variable home loan against just your new property.

Yes. You can apply for a pre-approval on your Bridging Loan.

Our Bridging Loan is available to customers who are selling their existing owner occupied or investment property, to purchase a new owner occupied property. The new purchase must be owner occupied.

Depending on the bridging period you choose, interest may be charged. The interest charged during a bridging period is structured as follows:

-

Months 1 to 3: No interest charged and no repayment required.

-

Months 4 to 6: Interest charged monthly, interest will be capitalised (added) to principal loan amount, no repayment required.

-

Months 7 to 12: (if 12 month bridging period selected) Monthly interest only repayments required.

Customer reviews

Refer your friends or family to loans.com.au and earn big rewards!

When they settle a home loan with us, you'll both receive a $1,000 reward. Plus, if they choose a car loan, you'll get a $250 bonus, and they'll enjoy $150 off their settlement fee. It's our way of saying thanks for spreading the word!+

+ T&Cs apply, view here